First Time Home Buyer Programs

Buying a home is one of the biggest financial decisions and largest investments you will make in your life. No pressure, right? To turn the heat up further, the rise in average sale prices can turn off potential home buyers from participating in the real estate market. Fortunately, there are incentives and programs available to first time home buyers which can help you realize your dream of home ownership. As you navigate the buying process there are some programs you might be eligible for that would provide you with some additional financial benefit:

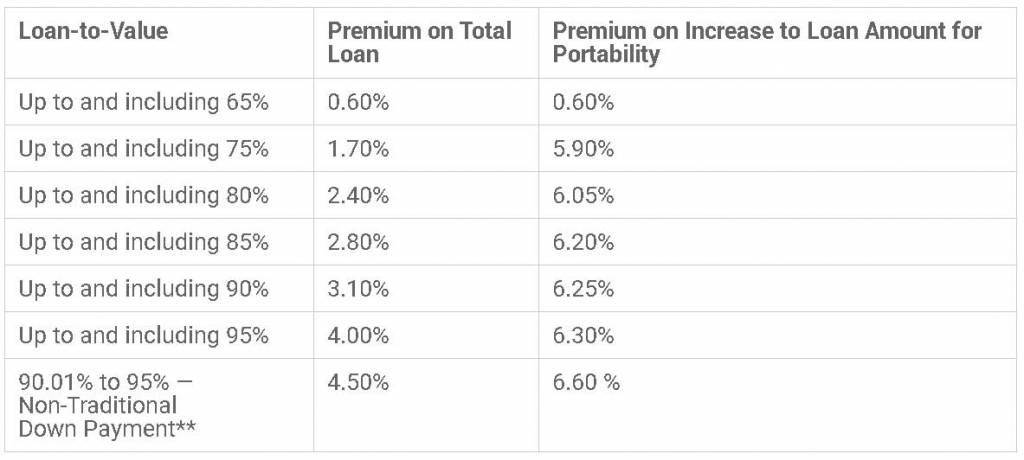

CMHC Insurance

CMHC Insurance is another term for Mortgage Default Insurance which you need to purchase when putting less than 20% down. This protects your lender in the event that you don’t meet your mortgage payments. Mortgage insurance is calculated as a percentage of the value of the mortgage amount.

*Source: www.cmhc-schl.gc.ca

In Canada, you must have a minimum 5% down payment for homes with a purchase price of $500,000 or less. However, for any homes falling in the $500,000 to $1 million category your minimum down payment increases to 10% for any additional amount beyond the initial $500, 000.

RRSP Home Buyer’s Plan (HBP)

The Home Buyer’s Plan allows first time home-buyers to withdraw up $25,000 tax-free from their RRSP to put toward the purchase of a home. To qualify you must not have lived in a home owned by yourself, your spouse or common law partner in the preceding four year period and the money borrowed from your RRSP must be in your RRSP for a minimum of 90 days prior to the purchase of your home.

This is an advantageous program for first time home buyers in Canada as early withdrawals from your RRSPs are otherwise considered taxable income. Just be mindful that you must start repayments of amount borrowed from RRSPs two years after purchasing over a 15 year period.

Land Transfer Tax Rebate

In Ontario, first time home buyers can receive a rebate on some of the land transfer tax you pay- up to $4,000! The requirement is that you have not owned property anywhere in the world up until that point.

First-Time Home Buyer’s Tax Credit (HBTC)

The First-Time Home Buyer’s Tax Credit is a program designed to help first time home buyer’s recover some of the costs associated with the purchase of a home, such as legal fees, disbursements and land transfer taxes. This is non-refundable credit with a maximum credit of up to $750 for any qualifying individual. If taxes owing are less than $750, the credit will be reduced. In order to be eligible you must not have lived in a property owned by yourself or your spouse or common law partner for four years preceding your purchase.

GST/HST New Housing Rebate

If you buy a newly built home, substantially renovate an existing home, or rebuild a home that was destroyed due to fire, you may qualify for a rebate on the GST portion of the new home purchase or renovation.

When you’re purchasing your first ever home, every little bit of financial assistance helps, so be sure to investigate what you qualify for! We wish you all the best on the purchase of your new home!